Increase Your Income: Shatter 3 Limiting Beliefs and Let's Assess Your Taxes

Join the Money Monday Newsletter for Entrepreneurial Therapists who want to cash in on increased income and financial clarity.

Hello!

Welcome to the first edition of the Money Monday Newsletter!

This week in "Mind Your Money" – we're zeroing in on 3️⃣ beliefs. They're blocking your earnings. We'll tackle them head-on.

"Ask The Expert" is up next – your go-to for 2024 tax calculations.

Ending with "Digital Doses" – spotlighting my top money app right now

Let's dive in!

Mind Your Money

Still, think hard work alone will fill your bank account? Spoiler: Your beliefs might be the real bankruptcy here.

Our thoughts about money impact our ability to earn more of it. How you think about your pricing, debt, what other therapists think about your business, etc all impact how you show up in your business every day. We all have deeply held beliefs about money…our ability to generate it, our ability to keep it, and questioning our worthiness of having it.

Today, we'll dive into 3 commonly held beliefs I’ve seen therapists hold and how you can challenge these beliefs:

Breaking Beyond Insurance Barriers

Common Belief 1: “I can’t make more money because of insurance”

The Truth: Your potential to generate income extends far beyond insurance reimbursements. There’s no limit to the ways you can generate income in your business outside of only taking insurance. You can offer workshops, online courses, sell digital products, host retreats, etc. You get to choose how YOU want to make money in your mental health business.

Challenge the belief: Brainstorm questions like: How can you leverage your expertise in different ways to serve your ideal clients? What additional services do you desire to offer that won’t require you to take insurance?

Embracing Your Expertise with Confidence

Common Belief 2: “My rates are too high for clients.”

The Truth: Value attracts investment. Many clients are willing to pay for the quality care they receive. How you position your services impacts the types of clients you attract. This goes to your marketing.

Challenge the belief: Evaluate your marketing. Does it convey the exceptional value you provide? Are you marketing your expertise in a way that aligns with the clients who are most ready to experience your services?

Balancing Financial Success and Client Care

Common Belief: “Focusing on profit means I don’t care about my clients.”

The Truth: Financial health allows you to offer better services. Profitability and client care are complementary, not conflicting goals.

Challenge the belief: Here’s something to consider, trust that your clients understand their financial situation. They know if they can invest in your services or not. If they can’t you can always provide resources for them, a referral, create free content, or plan for pro bono or sliding scale spots in your practice.

Your financial mindset is a powerful driver for your business’s success. By challenging deeply held beliefs about money (that may not even be yours to hold), you unlock new possibilities for growth and sustainability.

Remember, your services hold immense value, and embracing this fact allows you to thrive professionally while maintaining the integrity with your clients. Stand firm in your expertise, innovate confidently, and let your business flourish on your terms.

I encourage you to reflect on the following questions:

Which of the beliefs mentioned resonates most with you, and why?

What specific action can you take this week to challenge or change this belief?

How might your practice evolve if you shifted your perspective on these financial beliefs?

If you’re feeling inspired to share, I’d love to hear how you plan to implement these insights into your business.

Ask The Expert

In each newsletter, we'll take a question that you have about your finances and answer it here.

This week's question: How do I know how much I'll be taxed?

Let's get into it 👇🏾

First, let's set the right foundation...in the US, we have a progressive tax system. That basically means that as our income increases, we pay a higher tax rate. But also, because we're in the US and have to make everything extremely complicated, we pay taxes on a marginal basis. This means that all of our money isn't taxed at one rate.

Let's look at an example. Since we're business owners, we're taxed on our net income. That means we are taxed on the amount we have left over after we pay our expenses. This number is also called our profit.

Now, we are taxed based on our marital status. For the following example, I am going to assume you are married and had $100,000 in profit for 2023. Now, all of your money isn't taxed at 22%.

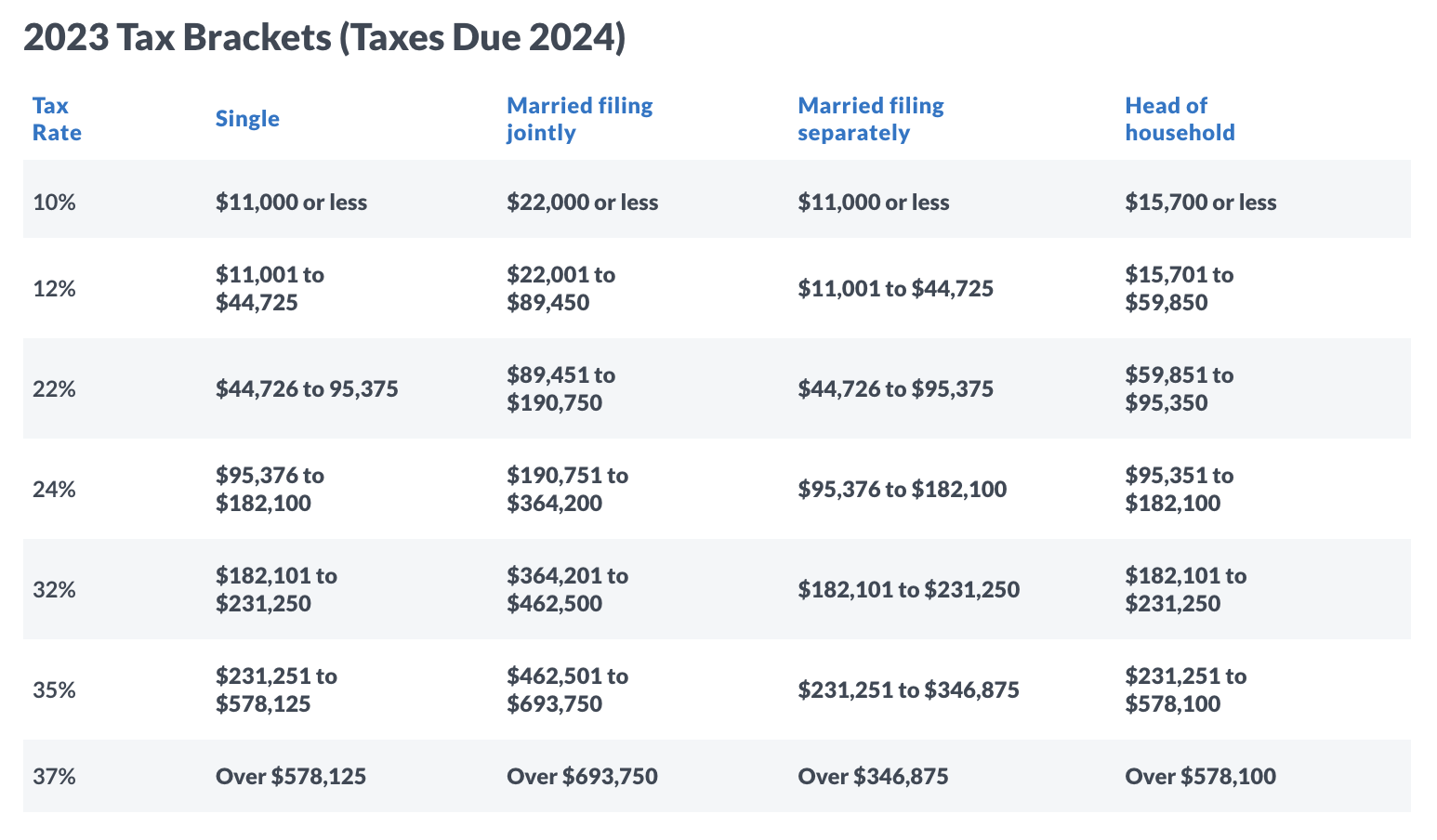

2023 Tax Bracket

Let's break this down in buckets:

Bucket 1 is 10%: $22,000 x 10% = $2,200

Bucket 2 is 12%: $89,450 - $22,001 = $67,449

After we find the difference, we calculate the amount $67,499 x 12% = $8,093.88

Bucket 3 is 22%: $100,000 - $89,451 = $10,549

After we find the difference, we calculate the amount $10,549 x 22% = $2,320.78

Total tax owed = $12,614.66

So, let's recap:

The US has a progressive tax system meaning we pay more in taxes if we earn more

The US has a marginal tax system meaning that our money gets taxed at different rates

This example is based on hypothetically earning 100k in profit and filing married filing jointly

Our tax system is complex and ever-changing. I recommend working with a tax professional to accurately calculate your taxes. This example gives you an idea of how your taxes are calculated based on your profit at the end of the year.

Digital Dose

Digital Dose is an area where I'll be sharing some of my favorite tech that I am using with clients.

This week, my Digital Dose spotlight is on Rocket Money.

Rocket Money is my favorite app to manage my personal finances. As someone who spends A LOT of time in spreadsheets, I prefer to keep my personal finances simple. Rocket Money allows me to budget, keep an eye on my subscriptions, remind me of upcoming bills, and all in all...keep my personal financial life together.

Check it out below.

Before you go...Did you know I have a private podcast?

It's all about how I am building our new signature group advisory program, Impactful Income Therapy.

Impactful Income Therapy is for entrepreneurial therapists who want to increase their income by refining their pricing and diversifying their services so they can increase their profit in 90 days.

To get the #BTS tea, click the link below to listen

Episode 0: Welcome → February 28th

Episode 1: Creating the Program: The Why Behind Our Journey → March 6th

Content Choices: What We Included and Why → March 13th

Disclaimer: The information share in this and all future emails are for educational and marketing purposes only from The Concierge CFO and does not equate to legal, tax, or financial advice in any capacity. Best financial advice can be rendered only through my company’s paid services. Please visit theconciergecfo.com for more info.